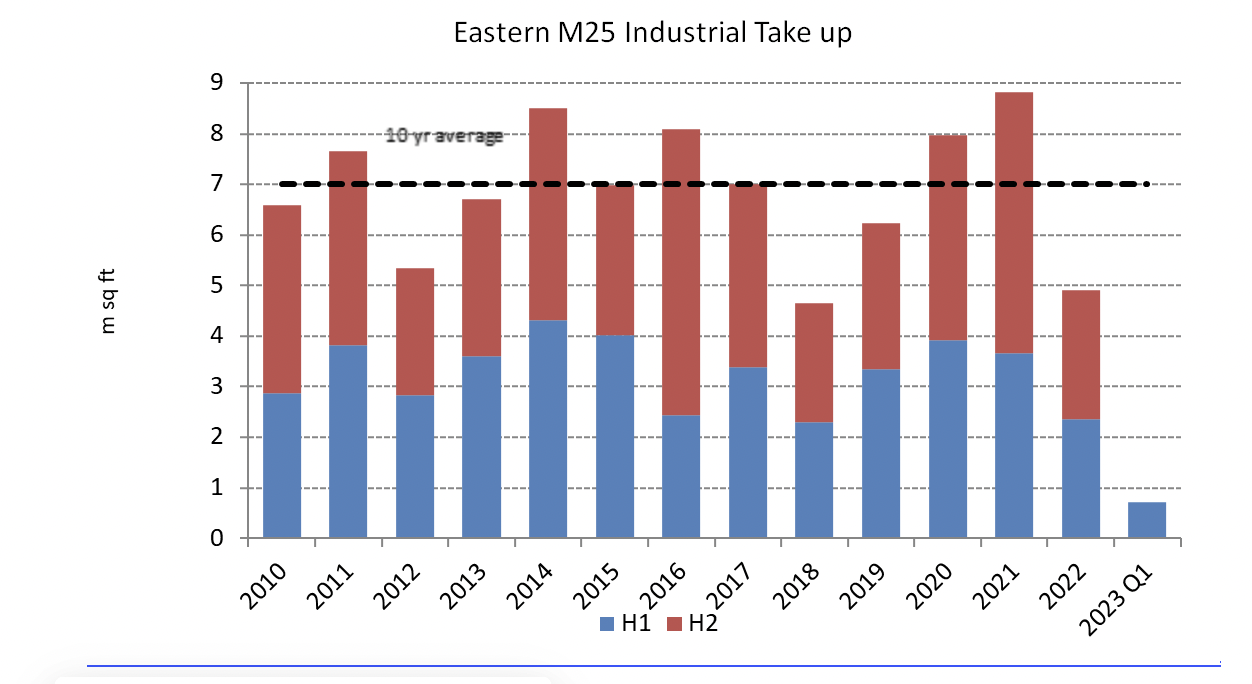

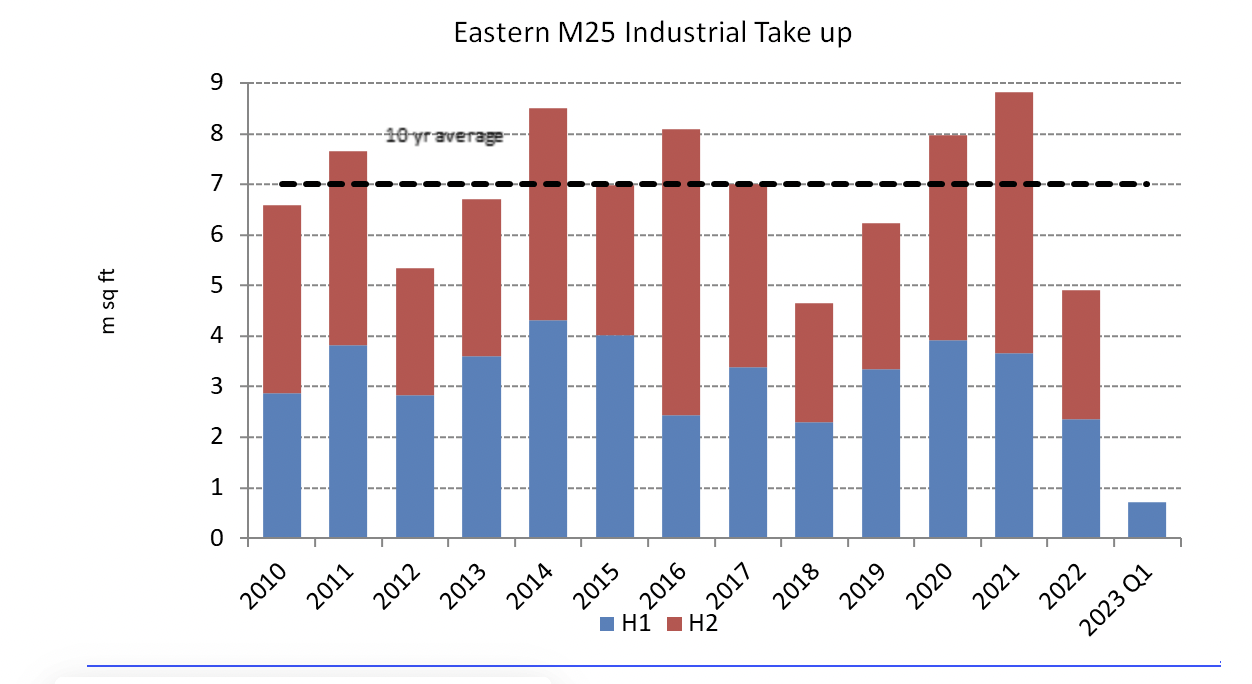

The latest Glenny research for the Eastern M25 region revealed the extent of the economic slowing in latter months of 2022, following the steady flow of economic and political bad news that rocked the market.

Take up fell below the long-run trend rate of activity after the two record breaking years which followed the pandemic. Total take up fell to 4.9m sq ft in 2022, 30% below the trend rate and 44% down on the levels of activity in the previous 12 months, with lettings of larger Big Box facilities almost grinding to a halt.

John Bell, Head of Business Space at Glenny commented, “The uncertainty created by international and domestic events in the second half of last year saw many larger corporates place occupational decisions on hold. Only one Big Box letting completed in the final quarter of last year and Transmerc’s deal at London Gateway has been the only larger letting to complete in our region in Q1 2023. This is in stark contrast to the norm for our market, where we see an average of 2m sq ft of Big Box lettings per year in eight or 10 deals.”

This slowing has come at an inopportune time, with a number of new larger unit schemes completing in the final months of the year and delivering grade A stock onto the market. Supply moved up to 11.2m sq ft, with grade A supply shifting up to 4.5m sq ft, 41% of overall stock on the market. The largest facility to be delivered is Goodman’s Purfleet343 at Purfleet Commercial Park, whilst Tritax and Bericote have launched Powerhouse300 in Dartford.

Bell reflects, “The increase in supply has been driven by the larger new facilities, but there is also a steady stream of new schemes at other size bands. The increase in grade A supply accounts for almost 90% of the overall upturn in space but with the impending EPC regulations fast approaching we envisage an increase in the flight to prime trend and expect owners of EPC compliant buildings to find it easier to attract occupiers following the introduction of the new legislation in 2027 and 2030.”

Demand for industrial floor space in the Eastern M25 is still holding up well despite the economic and political turmoil, with Glenny registering 20.7m sq ft of requirements in the six months leading to the end of March. Whilst this is some way below the peak levels recorded at the end of 2021, it is still well in excess of current supply (11.2m sq ft).

Bell concludes, “The demand for space on our patch is still strong and continues to drive the market. We traditionally see 65-70% of demand translated into take up in any one year, but this fell to 20% last year as the uncertainty created by the economic and political events affected the market. This may continue in the short term, but to date, the demand for floor space has remained strong and things do seem to be stabilising. There are some signs of optimism returning, albeit with an air of caution.”

Offices

Office market take up has remained below trend levels each year since the pandemic, and that trend continued in 2022. The second half of the year did show an upturn in activity in the Docklands market, and this may be a positive sign for the return to office working. There is evidence of a life science cluster beginning to establish itself in Docklands, with Kadans Science Partner and GIC committing funds to laboratory-based schemes.

Supply has increased but there remains a shortage of grade A space in all markets except East London and Docklands.

NB - The new EPC regulations will make it compulsory for landlords to deliver EPC Grade C compliant buildings by 2027 and EPC B compliant buildings by 2030 in order to continue to lease their buildings.

The full Q1 2023 Databook is now available to download here.