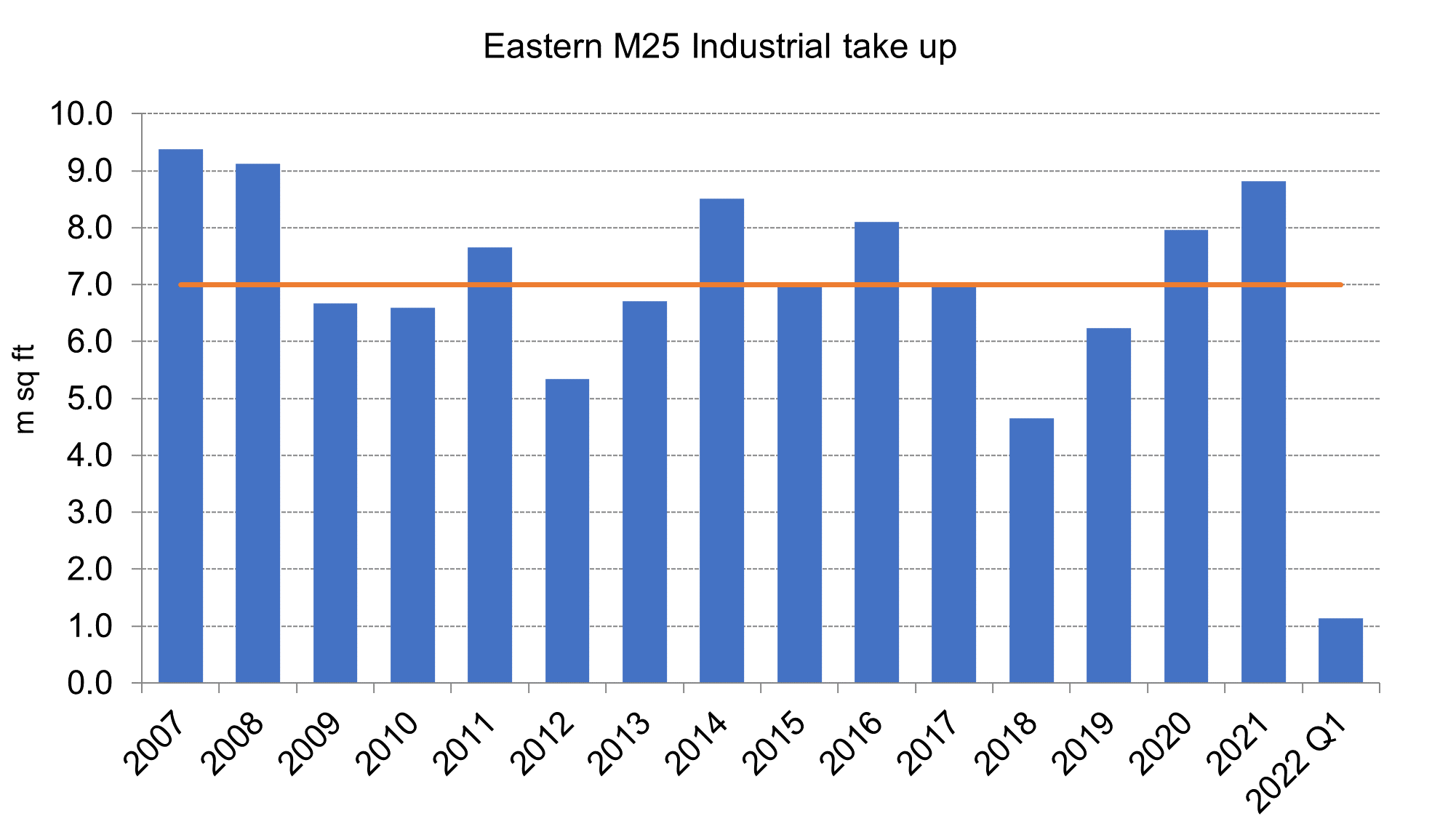

Industrial take up in the Eastern M25 market reached its highest since the boom years of 2007/08 last year, with a total of 8.8m sq ft of lettings. Activity was boosted by the continuous needs of companies to improve and rationalise their logistics networks in response to global supply shortages and rising transportation costs.

John Bell, Head of Business Space at Glenny commented, “Last year was a great year for our region, with the third highest level of take up on record and some great new schemes reaching completion. Leasing activity was close to the previous peak in 2007/08 and was boosted by a strong Big Box market, which has seen more than 7.1m sq ft of space acquired in 29 deals since the start of 2020. Despite the economic and political uncertainty, the Big Box market has had a strong start to 2022, with three deals signing in the first three months – two at London Gateway totalling 246,200 sq ft and a third at Ikon Harlow.”

More than three quarters of Big Box take up has been focused on new or design and build units, with occupiers preferring modern, energy efficient units to facilitate more efficient operation and whilst there are a number of new units on the market at the end of Q1 2022, these are primarily focused to the south of the river.

Bell adds, “There are some real differences in the current upturn in the market compared to the last time we saw take up at these levels. Supply of space is now far more restricted than in 2007/08, with overall stock on the market now down to 9.5m sq ft compared to just under 17m sq ft before the ‘Great Financial Crisis’. Similarly, demand across the region stands at 26.8m sq ft today, whereas it was 8.2m sq ft back then. This all seems to point to a continued good market in the rest of 2022.”

Rents have reacted to the strong dynamics of the market, with prime values up by 31.5% over the past 12 months and 50.9% since the start of the pandemic. Location is proving a strong driver to growth at the moment and inner M25 markets have performed stronger than locations outside the London Orbital, with prime values up by 37.7% and 64.9% over the comparable time frames.

Bell concludes that, “The strong rental market has been key to prompting developers to bring forward new schemes and we have seen more than 6.9m sq ft completed over the past two years but the majority of this stock has already been absorbed. There is just under 3m sq ft under construction at the moment but more than 50% of that is already committed. There is a need for more speculative built space across all size bands at the moment and as our research shows this will be met with strong demand.”

Offices

Take up in the Eastern M25 office market improved significantly in 2021, registering a total of 1.6m sq ft of lettings, 38% higher than the previous 12 months. Activity is still below the trend level for the region as a whole but both Essex and North London & Herts saw their respective levels of take up hit their 10 year average.

Supply is heavily focused towards the East London and Docklands market but remains constrained across the rest of the Eastern M25 market. Prime rents have edged up in some markets but remained largely stable. The next 12 months will prove interesting particularly with the long awaited opening of the Elizabeth Line in H1 2022, which will surely provide a much needed boost for the Eastern M25 office market.

For the latest commercial property insights, read Glenny's Q1 2022 Databook.