- Q3 2022 Databook is coming on 7th November

- Political turmoil creates uncertainty, but the market continues to tighten

- Occupiers still looking for better quality space, but supply levels are struggling to keep up

Our latest Databook, which covers the Eastern M25 region, paints a strong picture of the industrial and office sectors over the first three quarters of 2022, illustrating how the market responded following the pandemic but does not reflect recent market uncertainty following the government’s mini-budget in October.

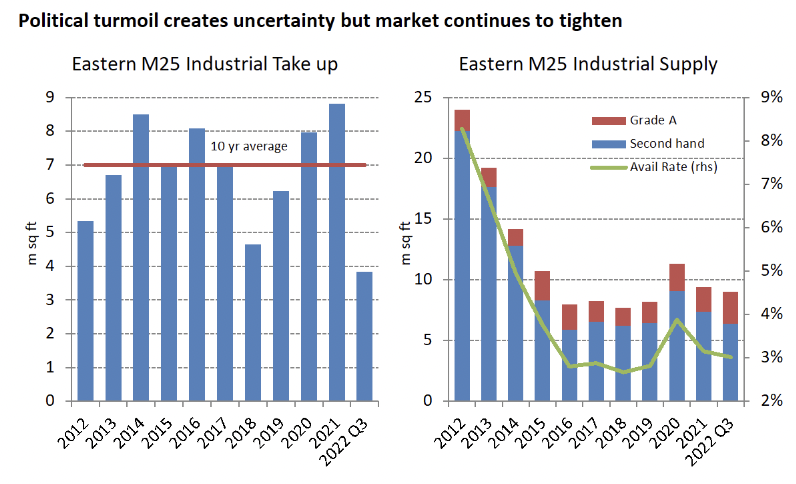

The research shows that industrial take-up to Q3 2022 slowed after strong leasing activity in the previous two years, with total lettings of just under 4m sq ft and full-year take-up expected to be below trend at 6-6.5m sq ft. Supply is now back to pre-pandemic levels, at just under 9m sq ft and although demand has reduced it remains comparatively high at 22m sq ft – almost 50% above the levels seen before Covid and showing little sign of abating.

John Bell, our Head of Business Space commented,

“The past few weeks have been a bit of a rollercoaster and it’s still far too early to call just how the market will adapt in the medium term. The uncertainty that has arisen is likely to cause developers and occupiers to defer some decisions which is never good for transactional business but, hopefully, the new Chancellor will settle some nerves.

“The increase in the cost of finance and its impact on capital markets has certainly caused the investment sector to adjust but some of these market corrections were already in motion ahead of the failed “mini budget”. Our latest research shows that prime yields in the Glenny region have moved out by 50-100 basis points, but the fundamentals of the occupier market are still positive, with an availability rate across our market of just 3%.

“Investors have certainly reassessed their views on the market and pricing has adjusted quickly, but occupiers are still looking for better quality space.”

While prime rents remained relatively stable across most of the Eastern M25 market, some within urban locations are now less “frothy” but it shouldn’t be overlooked that prime rents have increased by more than 50% from pre-pandemic levels.

Bell concludes, “There’s no doubt that we are expecting some slowing in the market, with activity returning to more normal levels, but supply chains have become increasingly important to the efficient operation of businesses and the economy over the past few years and that is unlikely to change.”

Meanwhile, demand for office space in the Eastern M25 office market rebounded in Q3 2022, with more than 2m sq ft of requirements registered on Glenny’s in-house system. Whilst there has been a falling away in larger requirements, tenants are focusing on smaller, better-quality accommodation to solve their occupational needs.

Supply continues to be the issue in the search for space, with a lack of new development and the loss of many well-located office buildings to residential, causing a downturn in availability. The majority of new space continues to be focused in Docklands and East London, and there are already signs of activity improving in these areas. Availability rates in all other submarkets in the Eastern M25 remain tight at around 5.0%.

The full Databook Q3 2022 will be available to download on 7th November. In the meantime, you can download our Databook from Q1 2022 here.